Income Brackets 2024 Uk Single Person. 1% of benefit per £100. 0% tax on earnings up to £12,570.

For the 2024/25 tax year the uk has a broad range of tax brackets, allowances and earnings thresholds. You pay income tax at the rates.

Income Brackets 2024 Uk Single Person Images References :

Source: jerrilynwdaisie.pages.dev

Source: jerrilynwdaisie.pages.dev

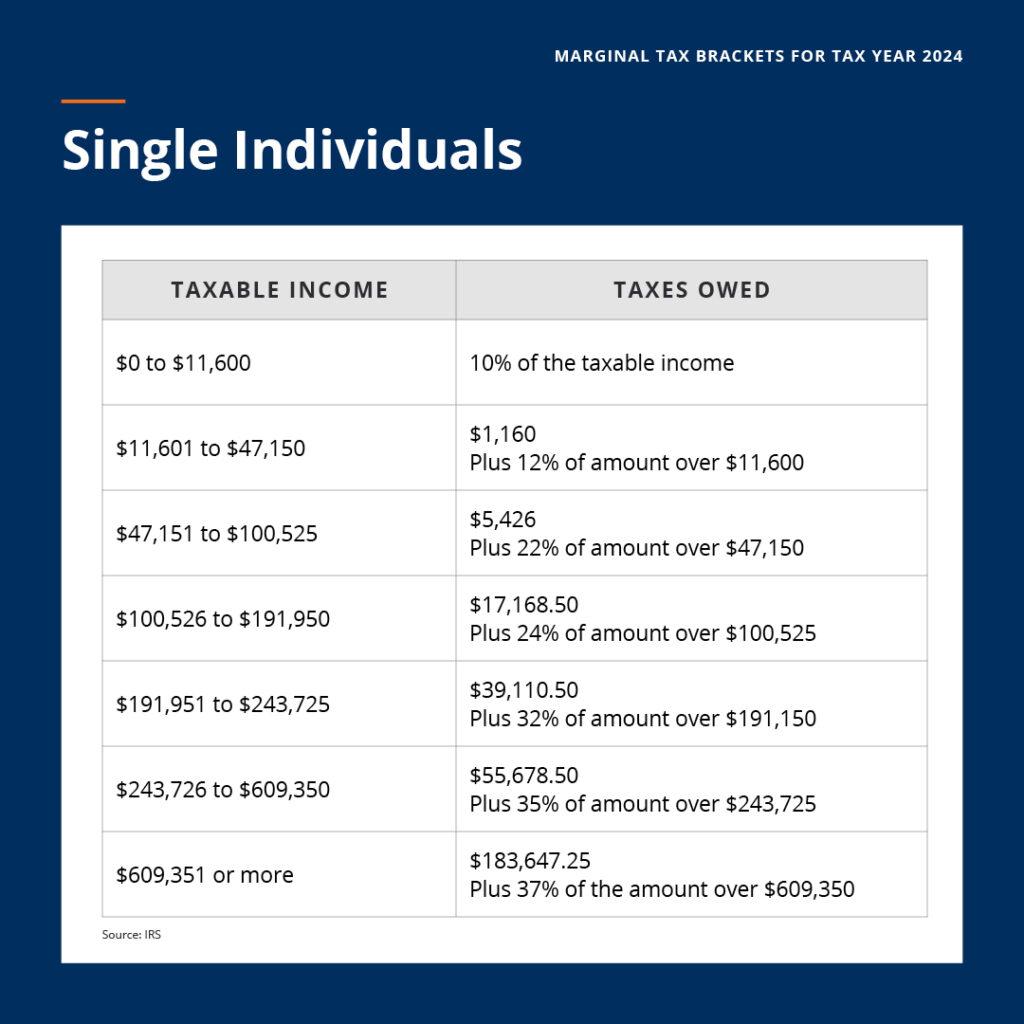

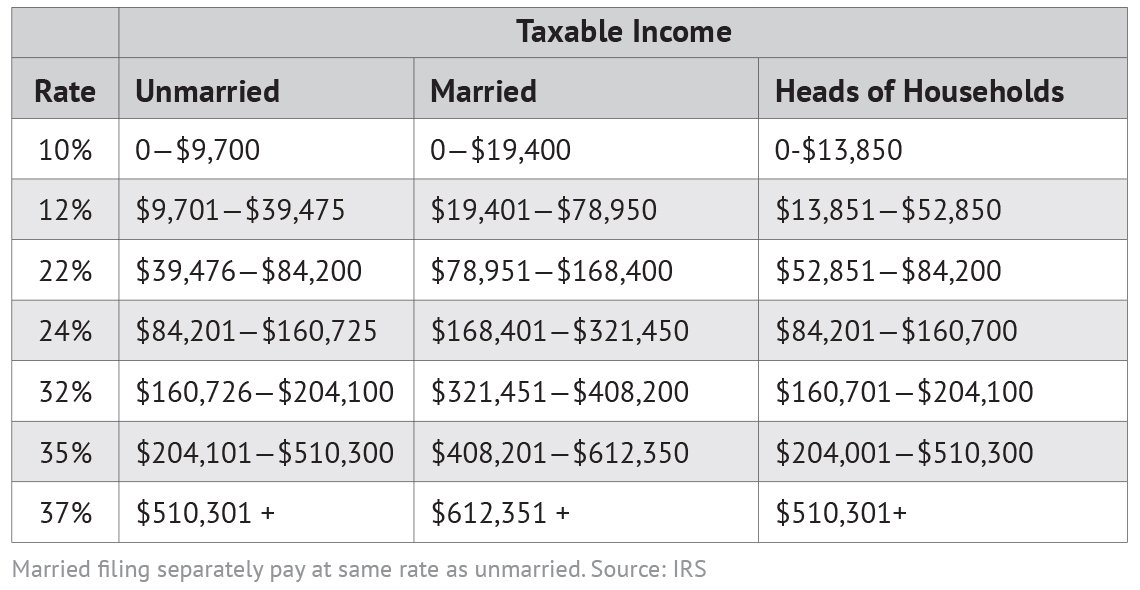

2024 Tax Brackets Chart Vonni Johannah, You pay income tax at the rates.

Source: fity.club

Source: fity.club

Bracket, 1% of benefit per £100.

Source: www.trustetc.com

Source: www.trustetc.com

2024 Tax Brackets Announced What’s Different?, The personal allowance is lost if taxable income exceeds £125,140 (2024/25).

Source: mayandjune2025calendar.pages.dev

Source: mayandjune2025calendar.pages.dev

20242025 New Federal Tax Brackets A Comprehensive Guide, High income child benefit charge:

Source: camilayshelley.pages.dev

Source: camilayshelley.pages.dev

Tax Brackets 2024 India Wilma Juliette, For the 2024/25 tax year, if.

Source: laurenewlise.pages.dev

Source: laurenewlise.pages.dev

Federal Tax Brackets 2024 Single Person Sile Yvonne, From income tax bands to capital gains tax and the marriage allowance, find out all the rates and allowances you need to be aware of for the 2024/2025 tax year (which started on 6 april) with.

Source: teodorawnat.pages.dev

Source: teodorawnat.pages.dev

Tax Brackets 2024 South Africa Single Margi Saraann, The table below shows the income tax rates and band thresholds for 2024/25 as well as for last year (2023/24) and next year (2025/26) in england, wales, and northern ireland.

Source: farandqcarlina.pages.dev

Source: farandqcarlina.pages.dev

Tax Brackets 2024 Single Person Angil Meghan, The table above shows 2024/25 income tax rates for taxpayers in england, wales and northern ireland who have a standard personal allowance of £12,570.

Source: timmyyalberta.pages.dev

Source: timmyyalberta.pages.dev

Tax Brackets 2024 Calculator Esta Olenka, Here’s a handy round up of the uk tax brackets and allowances for the current tax year (2024/25).

Source: kayleylyndel.pages.dev

Source: kayleylyndel.pages.dev

Tax Brackets 2024 Calculator Nj Gerta Juliana, The personal allowance is lost if taxable income exceeds £125,140 (2024/25).